-

Travel Insurance

-

By Policy

-

By Traveller

-

By Destination

See how much you could save Get a Quote -

By Policy

- Why Alpha?

See how much YOU could save! Get a Quote

-

Help Centre

-

Sales Assistance

-

-

Claims

See how much you could save Get a Quote -

Sales Assistance

- Media

See how much YOU could save! Get a Quote

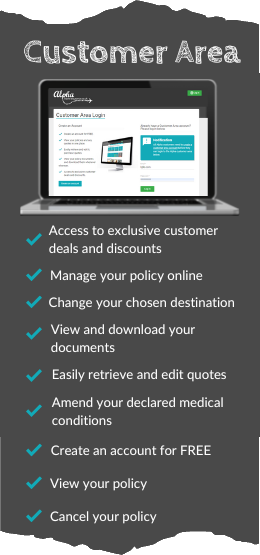

- Existing Customer

See how much YOU could save! Get a Quote

Call us: 0333 999 2676

Mon-Fri 8am-8pm, Sat-Sun 9am-5pm